•African e-commerce to reach $45bn by 2025 – Investors

•Reflects capacity of Nigerian tech entrepreneurs – NACCIMA

•Opportunities in ICT immense, low investment risk – Ex-LCCI boss

By Yinka Kolawole

In a seeming vote of confidence in the entrepreneurial capacity of Nigerians, foreign investors and a few local ones have staked $992 million (about N412 billion) as direct investment in 35 Nigerian-owned startups between January and October 2012.

Financial Vanguard findings from the Nigerian Investment Promotion Commission (NIPC) and other sources, also show that the startups are mostly in the technology space and cut across payment platforms, education technology, agritech, e-commerce, IT, legal tech, digital freight, fashion, gifting, QSR, mobility, etc.

The development is perhaps a testament to the ranking by the Global Startup Ecosystem Index 2021 released by StartupBlink which showed that Lagos (Nigeria) has overtaken Nairobi (Kenya) to become Africa’s top startup ecosystem.

Justifying the investment, financiers note that African e-commerce is accelerating faster than could have been imagined a decade ago, projecting that the industry could reach $45 billion in the continent by 2025.

READ ALSO: Worry, as foreign portfolio investments decline 44% to N262bn

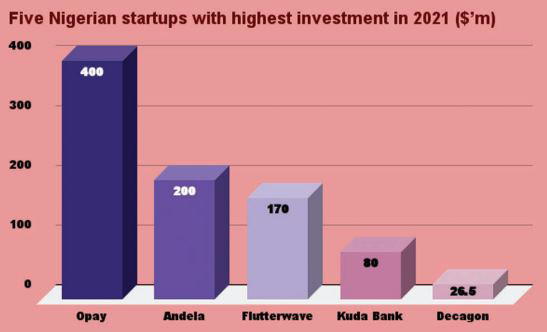

The top five beneficiaries of the investment funding are Opay which secured $400 million, Andela $200 million, Flutterwave $170 million, Kuda Bank $80 million (two tranches), and Decagon $26.5 million (two tranches).

OPay secured $400 million in August in a funding round led by SoftBank Vision Fund, the venture capital arm of Japanese conglomerate SoftBank, supported by Sequoia Capital China, DragonBall Capital, Redpoint China, Source Code Capital, SoftBank Ventures Asia, and 3W Capital. It is the single-largest investment round secured by an African-based startup.

Andela announced that it raised $200 million from investors in September, led by SoftBank Group Corp., a Japanese tech investor, backed by Whale Rock Generation Investment Management, Chan Zuckerberg Initiative, and Spark Capital.

Flutterwave raised $170 million in Series C round in March, led by New York-based private investment firm Avenir Growth Capital and U.S. hedge fund and investment firm Tiger Global.

Other investors include DST Global, Early Capital Berrywood, Green Visor Capital, Greycroft Capital, Insight Partners, Salesforce Ventures, Tiger Management, Worldpay FIS and 9yards Capital.

Kuda Bank raised $55 million in a Series B round in August, coming after raising Series A of $25 million in March 2021.

The round was co-led by existing investors Target Global and Valar Ventures, supported by SBI Investment and other angel investors.

Decagon, IT startup, has raised a total of $26.5 million in 2021. It raised $1.5 million in August, led by Kepple Africa and Timon Capital, backed by Tokyo-based UNITED Inc.

This is in addition to the $25 million student loan financing facility it earlier raised, made possible by a partnership between the financier, Sterling Bank, and the Central Bank of Nigeria (CBN).

Mono, a financial data startup, also raised a total of $17 million in 2021 – $15 million in Series A round in October led by Tiger Global, in addition to a seed round of $2 million earlier raised in May.

Autochek, auto-tech startup, raised $13.1 million seed funding round in October, co-led by follow-on investors, TLcom Capital and 4DX Ventures, including existing investors Golden Palm Investments, Enza Capital and Lateral Capital as well as new participants ASK Capital and Mobility 54 Investment SAS – the venture capital arm of Toyota Tsusho Corporation.

Alerzo, an Ibadan-based e-commerce retail startup, in August announced a $10.5 million Series A round led by London-based Nosara Capital, with FJ Labs and other investors from the U.S., Europe and Asia participating in the round.

Two startups, Appzone, a fintech software provider, and Verto, a B2B payments platform for small and medium-sized enterprises (SMEs), raised $10 million each in August and October respectively; Lidya, SME finance fintech, raised $8.3 million in July; Eat N’Go, Quick Service Restaurant (QSR) operator injected $5 million into its operations in August; while Releaf, a tech-enabled food processing company, secured $4.2 million through a seed round and a series of grants to scale its business across the country in September.

CapitalSage Technology Limited raised $4 million in August; Prospa, a software and financial services provider closed $3.8 million pre-seed investment in September; Cowrywise, a fintech startup, raised $3 million in pre-Series A funding in January 2021; and Omnibiz, a Business to Business (B2B) e-commerce startup, secured $3million in August.

Similarly, Sparkle, a digital bank startup, raised a $3.1 million seed round in October; Definely, London-based Nigerian legal technology startup, raised $3 million in pre-seed funding in September; ReelFruit, a dried fruit company, announced a Series A investment of $3 million in September; Klasha, payments provider, in October secured a sum of $2.4 million; Bankly, fintech startup digitizing cash for the unbanked, closed $2 million seed round in March; and Rooomxix, an urban streetwear fashion brand, announced an investment of $1.5 million in August.

Sendbox in October raised $1.8 million seed; Chaka, a trading and investment platform, raised $1.5 million in pre-seed funding round in July; MVX, a digital freight and hauling company, raised a $1.3 million seed round in August; Mobility startup Plentywaka also raised a $1.2 million seed round in August; while Payday, a fintech company, raised $1 million in October.

Others are: Edu-tech startup Edves that raised $575,000 seed funding round in October for online schools; Chekkit, anti-counterfeiting startup, raised $500,000 pre-seed funding round in August to expand operations within the pharmaceutical and FMCG industries;

Bitmama, payment platform, raised $350,000 pre-seed funding in October; gifting startup Showlove announced a $300,000 pre-seed funding round in August; Bumpa, e-commerce startup, raised $200,000 pre-seed in September;

Zowasel, Agritech startup, received $100,000 investment in July from Guinness Nigeria Plc and pan-African consumer packaged food manufacturer Promisador Nigeria Limited, and Jise, a food-only delivery platform, raised $100,000 angel funding in October from investors in Nigeria and Europe, including Backroom Capital (Nigeria), Winston Capital (Ireland) and a few angel investors.

Investors speak

Kentaro Matsui, Managing Partner, SoftBank Vision Fund, on the investment in OPay, said: “We believe our investment will help the company extend its offering to adjacent markets and replicate its successful business model in Egypt and other countries in the region.”

Lydia Jett, a founding partner of SoftBank Investment Advisers, said: “Hiring remote technical talent is one of the top difficulties that businesses confront today.

“As remote and hybrid work arrangements become the standard, we believe Andela will become the chosen talent partner for the world’s greatest firms.”

Jamie Reynolds, Partner at Avenir Growth Capital, said: “Flutterwave is at the forefront of innovation in payments technology, and we are excited to support the team as they build the last available payments infrastructure frontier in the world – connecting merchants and consumers intra-Africa and globally.”

Andrew McCormack, General Partner at Valar Ventures said that Kuda’s approach to the market was the reason behind its decision to invest in the startup.

“With a youthful population eager to adopt digital financial services in the region, we believe that Kuda’s transformative effect on banking will scale across Africa and we’re proud to continue supporting them,” he added.

Walter Baddoo, co-founder and general partner at 4DX Ventures, said of the Sendbox’s seed round: “African e-commerce is accelerating faster than anybody could have imagined a decade ago and it needs smart solutions to ensure that logistics and fulfillment capacity doesn’t lag behind.

“Not only were we impressed by Sendbox’s 300% year-on-year growth since launch, but we’re seeing the market potential balloon with over 40 million Nigerian SMEs and a projected industry value for social and e-commerce reaching $45 billion on the continent by 2025.”

Analysts’ comments

An economist and CEO, Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, who is also former Director General, Lagos Chamber of Commerce and Industry (LCCI) said: “The ICT sector is one of the fastest growing in the Nigerian economy.

“In the last two quarters the sector posted a GDP growth of 17.92 percent in Q2’21 and 14.91 percent in Q1’21. Even the pandemic boosted growth in the sector as businesses leveraged ICT to facilitate recovery.

“The opportunities in ICT are immense and the investment risk is relatively lower when compared with other sectors.

“It is also a sector driven largely by the younger generation of investors who are very innovative, dynamic and mobile.

“These are some of the factors that may have been responsible for the relatively impressive investment outcomes in the sector.”

Director General, Nigerian Association of Chambers of Commerce Industry Mines and Agriculture (NACCIMA), Ambassador Ayo Olukanni stated: “Certainly these figures on these Nigerian owned Startups are a reflection of the confidence in the potentials of the Nigerian economy and much more importantly the potential return on investment.

“Nigeria may be a difficult economic terrain but it remains an attractive spot for any discerning investor who can take a long view of history.

“The capacity of Nigerian tech entrepreneurs has also been demonstrated beyond all doubt. The growth of the Fintech sector has been the work of innovative skilled young Nigerians.

“They are our bold and creative Tech Entrepreneurs who have floated and are operating some very successful Startups.

“This is surely a reflection of the entrepreneurial spirit of the increasingly young tech-literate generation of Nigerians; consequently they will continue to attract venture capital from across the world.

“The decision by Google to include Nigeria in its $1 billion Support Fund for Africa’s Digital Transformation is not surprising.

“And I think we will see more interest in the Nigerian Digital and Telecom sector and Start Up of our young Tech Entrepreneurs as we continue upgrading our Digital Infrastructure just as witnessed with the launch of the 5G Policy which is part of our National BroadBand Plan 2022-2025.”

The post Foreign investors stake N412bn on 35 Nigerian startups appeared first on Vanguard News.

0 Commentaires